How to Start a Business with No Money

Jan 7 • 10 min read

Want to start a business but have no money? You are wrong if you think this is stopping you from becoming an entrepreneur. Having no money when starting a new business can be a strong advantage.

In this article, we will walk you through the processes of validating your business idea without any investments needed and how to ensure funding to start operations. Companies like Patagonia, Apple, and Dell started with little to no initial capital and were developed into worldwide brands. You can do the same following the script below.

Reasons to Start Your Own Business

Becoming an entrepreneur is an important step regardless of whether you are leaving a professional career as an employee or have never had a job before. Different people have different motivations to start their own business:

- Freedom and flexibility for when and how much to work

- Ownership and responsibility for the success of a company

- Status and recognition by others for the successful company built

- Financial benefits - owning a company can be monetary rewarding

- Making a difference in the world by solving a problem that you care about

As you can see, the reasons to become an entrepreneur can be all over Maslow’s pyramid, and you probably have your own blend of reasons to pull the trigger.

The Power of No-Money Mindset

Many aspiring entrepreneurs consider the lack of funding a dealbreaker for going all-in with their business ideas. In fact, starting a company without investment can be very beneficial, as it boosts creativity and resourcefulness.

Founders without capital are forced to leverage their existing skills, network, and free resources. It also forces discipline, focus, and radical prioritization.

Well-funded companies often jump into premature hiring of employees or expensive consultants, and other activities that may not be justified at this stage of the company.

How to Progress Towards Your Idea with No Investments

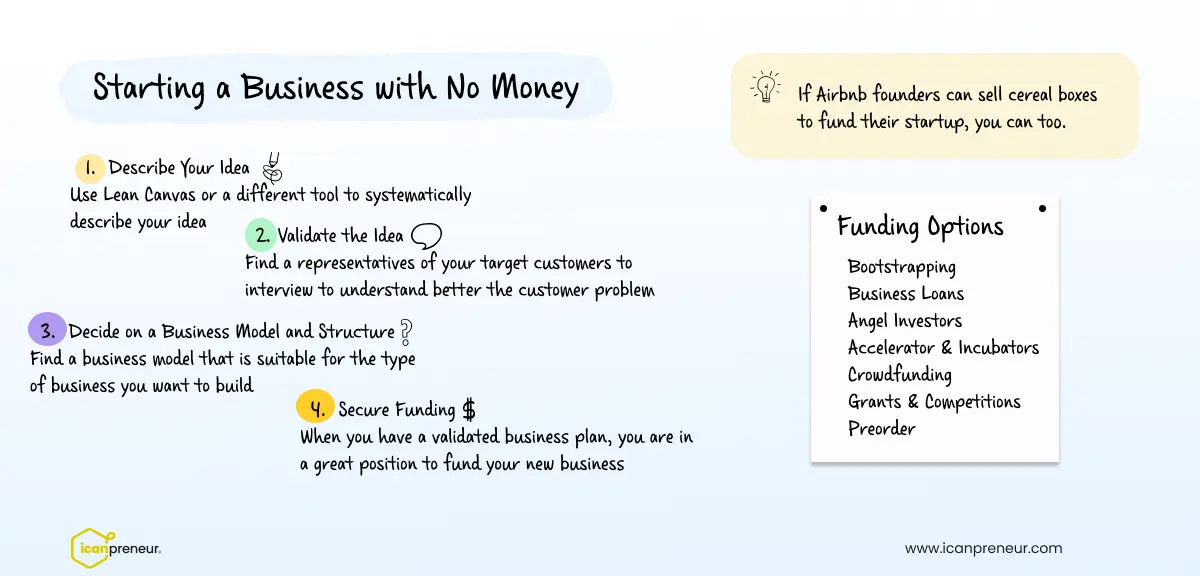

There are many things you can do to make progress on your idea without having to spend money. Next, we will go through a step-by-step list to get from zero to a validated idea.

Step 1: Describe Your Idea

If you already have a specific idea for a business you want to develop - describe it in detail. This will give you clarity and a platform to explain it to others along the way.

Being able to explain your idea quickly and clearly is essential as you will have to do it at least three times every day to different types of people:

- Potential customers

- Partners

- Employees or team members

- Investors

One of the best and industry-recognized ways to express your idea is to use the Lean Canvas.

If you still don’t have an idea you want to pursue, check out the “How to Start a Business with No Ideas” article for inspiration.

Step 2: Idea Validation

After you have your idea laid out, it’s time to validate it. The most credible way to validate it is to use customer interviews to gather real-world data from your potential customers.

When conducted well, customer interviews provide invaluable insights into:

- Your target audience's customer problem and needs,

- How they shop for a solution,

- What alternatives they use today,

- The opportunities for you to provide better products or services.

This is one of the most underestimated steps and a common reason new businesses fail. Many founders and product leaders decide to skip or fast forward because:

- “I know the problem myself and don’t need more validation.”

- “Customers don’t know what they need,” quoting Henry Ford

- “I already showed the actual product or service to 10 friends, and they said it’s great.”

We have heard this many times, and the problem with these statements is that:

- It uses other people's opinions, which are not equal to their behavior

- Doesn’t provide insights into how important the problem is or how many of them have it

- Has no insights on how to reach out to your customers where and when they need your company with a message that resonates with them.

Customer problem research may sound intimidating, but these are just conversations between you and other people, which, when conducted accordingly, will inform most of your plan ahead. For a detailed explanation of how to do that, check out the Customer Interviews: A Step-by-Step Guide to Market Research article.

Step 3: Decide on a Business Model and Structure

If you deeply understand the customer problem and how you might address it, it’s time to define your business model. This is a critical step as it outlines how you can deliver value to your customers and build a sustainable business around it. There are various types of business models, and you need to pick one that fits your business case.

Up to this point, you haven’t spent money on anything, but you have made important progress and made some decisions:

- You know who are the customers you will be addressing.

- You know what problem they have, how painful it is, what they use to solve it today, and where these existing alternatives fall short.

- You have a hypothesis about what value proposition will resonate with the target audience and what channels to use to get to them.

- You can provide a business case that includes market sizing, a business model, go to market strategy.

This is a great foundation for moving forward to execution. If that step requires some funding, you have all the ingredients to secure that funding. Next are the funding options that you can consider.

Funding Options

Bootstrapping

Bootstrapping means starting a business with your own money. This money could come from personal savings, salary from a full-time job, passive income, or maxed-out credit cards. Famously, Airbnb, GoPro, and other unicorn startup founders had to use their credit cards to finance their companies' first steps.

This approach may be applicable for your business is not capital intensive, and you need a small amount mainly for legal and compliance setup like:

- Registering a business

- Opening a bank account

- Getting an accountant

- Renting an office space

Business Loans

A small business loan may be a viable option if your business requires initial investment to get it going and won’t require ongoing financial investments. Such examples could be buying equipment or securing other assets that are essential for running the business. The benefit of a bank loan is that you won’t lose equity in your company but will have to pay interest.

Angel Investors

Friends, family, or experienced angel investors are another option to secure startup capital. Those investments are usually in exchange for ownership of the company. The added value of onboarding angel investors is the access to their network and skill set. Often, this is a more valuable contribution than the capital they bring in.

Accelerators or Incubators

Accelerators and incubators are organizations that help entrepreneurs validate and scale their ideas. Accelerators usually provide funding and training programs but are suitable for companies that already got some traction. Incubators welcome companies in their earliest stages, but funding is not always an option. To help you pick the best option for your company, we have outlined the difference between Accelerator and Incubator in a separate article.

Crowdfunding platforms like Kickstarter, Indiegogo, GoFundMe

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to pitch their ideas and raise funds by selling swag, gratitude, or the actual product before building it.

This is a great way to validate you. People are backing your product with their money, and there is no greater testament that your product messaging resonates with them.

However, those platforms are usually used by a specific group of techy and early adopters, which may not fall within your target market. GoFundMe is a more general-purpose platform that you can use. It’s more applicable for socially responsible types of businesses as backers tend to resonate with the mission of whom they support.

Grants and/or Competitions

Different public and private organizations provide small business grants or contests for new businesses. Winners often receive funding and additional benefits, such as mentoring, access to additional services, and networking opportunities.

Grants and competitions are usually time-sensitive and must fit into your business plan's time scope.

Preorder

Preordering is when you offer customers the opportunity to buy your product or service before it’s ready, usually at a reduced price, in exchange for elevated access to the product or the product team.

The concept is similar to crowdfunding platforms, but you must handle the go-to-market process. If you have the capacity to plan and execute such a campaign, this can attract customers who are not using crowdfunding platforms. You will also save on the fees of these platforms. However, using crowdfunding can save you time and give you easy access to hundreds and thousands of customers.

Next Steps

Once you decide on the strategy to fund your enterprise and secure it, it’s time to set up officially your business and start operations.

Real-Life Story

In 2007, two people were on their way to build one of the biggest businesses in the hospitality industry. But at that time, they had issues even paying their rent. To help with that, they started renting out air mattresses in their apartment to strangers in exchange for a fee. This idea started growing, but they had no resources to scale and market it.

They used all their credit cards to get past this point, but this was still not enough. Then, they came up with the idea of selling their brand of cereal boxes, “Obama O’s and Cap’n McCain’s.” This did the job; they raised $30000 to keep the company running.

Brian Chesky, founder of Airbnb, tells the rest of the story on the How I Built This podcast with Guy Raz.

Common Mistakes to Avoid

Overestimating Free Resources

Sometimes, you can cut other costs or save a lot of time in exchange for a small fee. For example, Icanpreneur can save you days and weeks of work for validating your idea at the cost of one book (or three lattes) per month. The platforms pack years of experience and numerous methodologies with the latest AI technologies to give you an easy-to-follow entrepreneurial journey that will get you up and running with your idea in less than 1 hour.

Targeting Everyone as a Customer

Building a product or service that appeals to everyone means that it will appeal to nobody. Great companies are obsessed with knowing their customers and developing strong buyer personas. That’s why conducting customer interviews is such an important step in the process of building a business.

Neglecting Legal and Regulatory Requirements

Failing to register your business or understand industry regulations can have severe consequences for the organization and for you personally. Also, depending on your location, there might be different options to run your business, resulting in significantly different financial and other obligations. Don’t miss to consult with a lawyer, accountant, and tax consultant on those topics, as this can save you money, time, and problems with the authorities.

Wrap Up

Having limited or no capital is not a blocker for starting your own business. It can actually be your secret weapon. You can make amazing progress on validating your idea without having to invest money. In addition, there are platforms like Icanpreneur that can save you hours and days. At the end of the day, the time we have is even more limited the money.

Author

Product @ Icanpreneur. Coursera instructor, Guest Lecturer @ Product School and Telerik Academy. Angel Investor. Product manager with deep experience in building innovative products from zero to millions of users.