Customer Interviews vs Surveys: No Need to Choose Anymore

Feb 24 • 8 min read

Understanding customer needs is the foundation of building a strong product that customers love. A deep dive into customers' problems cannot happen in isolation. Books, market research, and analyst reports can provide very high-level general information that lacks the level of detail needed to build a successful product. The only reliable source for customer insights is the customers themselves.

Two familiar techniques for conducting problem discovery are customer interviews and customer surveys.

What Are Customer Interviews?

Customer Interviews are qualitative research methods used to understand a target audience's needs, problems, and behaviors in detail. Customer interviews represent conversations between you and potential, current, or past customers to understand their past and current experience in solving a particular problem they have.

This approach allows entrepreneurs and product builders to gather detailed insights and validate their assumptions when laying out a business idea. Examining customers' detailed experiences can uncover important nuances and details that can significantly impact your business strategy.

What Are Customer Surveys?

Customer Interviews are a quantitative research method that measures different aspects of customers' experiences with a specific need or problem.

Surveys can be run with online questionnaires, telephone calls, or face-to-face interactions. The list of questions that the survey respondents need to answer is usually a set of closed questions with optional comments to provide additional clarity, and often, the questions ask to provide a quantitative answer like:

- How likely are you to recommend this product?

- How important is it to solve the customer problem to you?

- How disappointed you will be if <a feature> is no longer available to you?

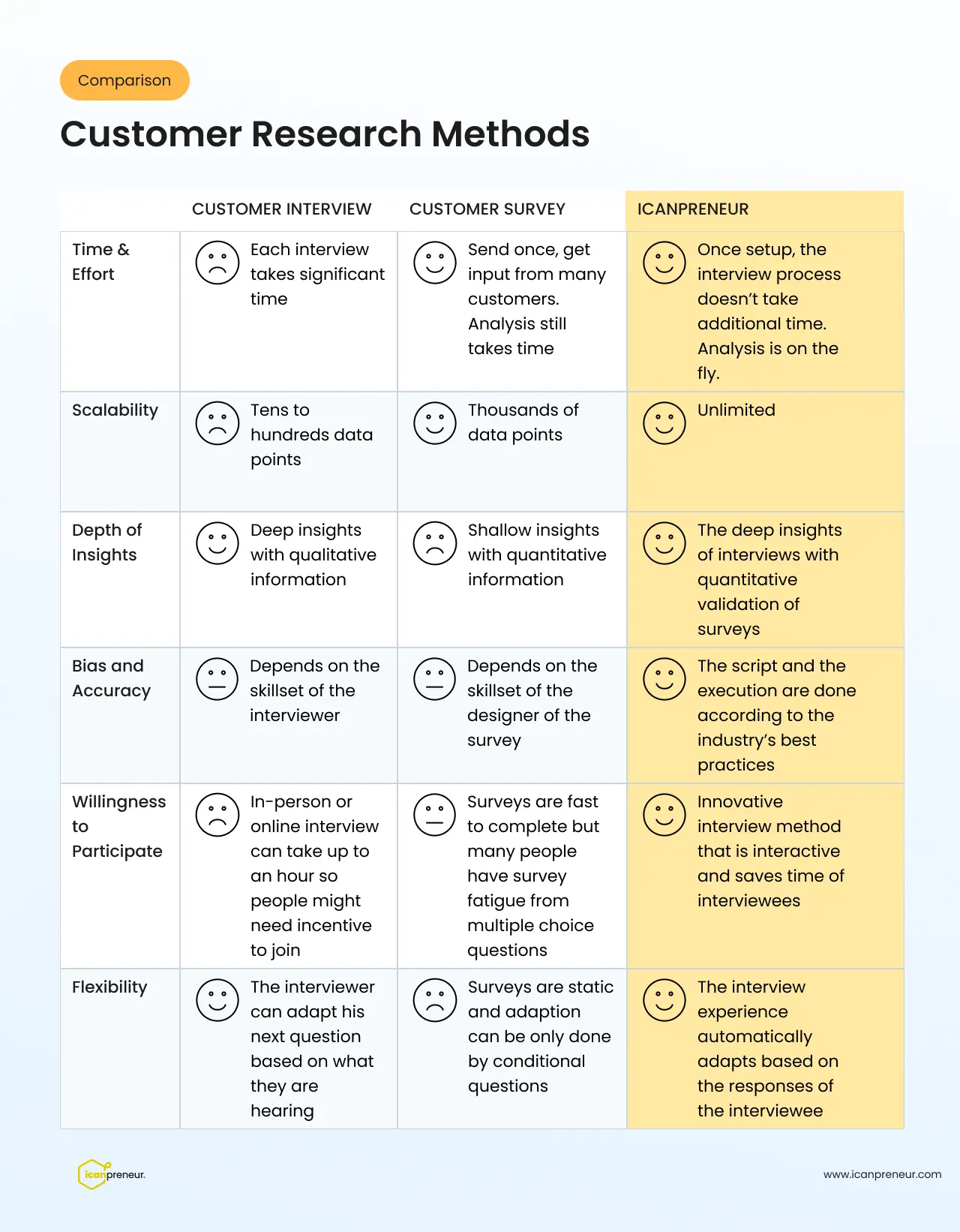

Customer Interviews vs Customer Surveys: Pros and Cons

Time & Effort

In terms of effort and time, both research methods require preparation. The results of the interviews or the surveys will be significantly influenced by what questions are asked and how they are asked.

So, making sure you ask non-misleading questions is a time-consuming task. It’s similar to analyzing the results after the data is gathered. Both methods require thorough analysis to extract reliable insights.

The time and effort needed for an interview are significantly higher during execution. A customer interview usually takes at least 30-40 minutes, with 15-20 minutes before and after it to warm up and unwind. This will give you just one data point.

Hundreds or even thousands of people can complete a survey in the same amount of time, provided that you have an appropriate audience and really engaging outreach.

Time is probably the most frequent reason for entrepreneurs and product leaders to skip customer interviews and instead conduct surveys or go directly to the building. However, this decision can also lead to premature investments and the creation of a product that people don’t need.

Scalability

Due to the amount of time involved in conducting customer interviews compared to a survey, the survey method is much more scalable. It allows the capture of data points from huge amounts of potential customers.

With interviews, you will rarely go beyond 50 interviews as this can easily take months of work.

Also, a survey can be completed on demand when the respondent finds time, while interviews have to fit into the schedules of both the interviewer and interviewee. This can create a queue of interviews distributed over a long time interval.

Depth of Insights

Customer interviews really shine in terms of depth of insights. Each unveils a unique story with a high level of detail, including struggles, emotions, and unexpected turnarounds.

Customer interviews often show blind spots in your business idea that might support or detail your business strategy.

Unlike surveys, where the researcher’s perspective heavily influences the information provided and what they think is important, customer interviews can be significantly influenced by the interviewee and their personal story.

Surveys are great at providing information at scale, but they miss depth. If you have a respondent who rates your product unfavorably, the chances that you understand why are very low, and they get even lower if the reason is “unknown unknown” to you.

Since surveys aggregate the data, they drop important nuances and differences between the different respondents. However, these differences are important as they can help with segmentation or even deprioritizing a certain customer segment that isn’t promising in favor of another one that has a bigger need.

Bias and Accuracy

The results from both the customer surveys and interviews can be influenced by the way the questions are asked. However, with the survey, you have to nail them once and deliver the same experience to respondents. With customer interviews, during every conversation, the interviewer should be mindful about having them ask questions - not only wording but intonation, facial expressions, body language, etc. Even the reactions to what the respondents are saying can swing their answers in one or the other direction.

Willingness to Participate

Getting reliable results with any research method always requires a large enough sample size. Sourcing participants for your research is a strong friction point.

In general, it might be easier to find leads for a survey as they can be done automatically when the participant has time and can be completed faster.

Customer interviews can be intimidating for participants, especially when discussing personal matters. Respondents may feel highly reluctant to participate, especially when exploring sensitive topics like personal relationships, health, and financial status.

Flexibility

Customer interviews are a more flexible research method. They allow the researcher to change the course of the conversation based on what the participant says.

Conversely, the surveys always ask the same question to every participant, and the levers for altering the experience are minimal.

The Icanpreneur Way to Customer Research

The latest update of the Icanpreneur platform offers a revolutionary approach to customer research. It uses the latest AI technologies to offer the best of both worlds. You no longer have to choose between an interview and a survey.

AI-led interviews are customer interviews that are conducted by IVA (the Icanpreneur Virtual Assistant) with your customers. With IVA, you can build an interview script that will be used as a foundation during each interview but will be adapted to extract maximum insights from the respondents.

The IVA-led interviews take advantage of customer interviews and online surveys, eliminate their weaknesses, and combine them into one single research method that:

- Scales

- Requires no time and effort from your side

- Adapts to what the participant is saying to extract unique insights from each conversation

- Engages respondents to participate by providing innovative experience

- Eliminates bias by following the industry’s best practices every time

Most importantly, you get deep, valuable insights confirmed at a large scale.

Try It Now

FAQ

The best way to start is to look for people from the target audience in your own network. These people will be more willing to help you and can connect you with people outside your network to quickly expand beyond your own circle.

Icanpreneur is the best way to handle the whole process of customer research, from the preparation of an interview script to analyzing and aggregating insights. The analysis is based on the industry’s best practices for customer research.

Conflicting insights from customers is a common situation. If there is a divergence in a big group of interviews, there might be multiple customer segments with different customer needs that are emerging. If you see one or two outliers and the rest of the feedback is similar - maybe you have participants in the customer research who are not good representatives of the customer segment that you are researching.

Qualitative research is great for exploring ideas, problem discovery, analyzing behavior, etc. The result can be used for coming up with new ideas, creating a precise definition of a customer problem, or building a hypothesis for a possible solution.

Quantitative data is useful to confirm theories, size a problem, and quantify other aspects of your business idea. Both types of research should be used in combination iteratively. Icanpreneur combines both types of data in a single research, providing holistic analysis.

Author

Product @ Icanpreneur. Coursera instructor, Guest Lecturer @ Product School and Telerik Academy. Angel Investor. Product manager with deep experience in building innovative products from zero to millions of users.